NACA things to do, attractions, restaurants, events info and trip planning

Basic Info

NACA

3824 W Sligh Ave, Tampa, FL 33614

4.6(320)

Open until 12:00 AM

Save

spot

spot

Ratings & Description

Info

Cultural

attractions: , restaurants: Otsuka Ramen, Danny's Coffee & Friends, Taco Bell, Big G's Pizza & Grille, McDonald's, TNT BURGER, Marlene's Original Breakfast Sandwich, Dunkin', SATA Empanada, Coco Loco Cafe, local businesses: Cody Pools, Cox's Seafood Market, Palm Casual Patio Furniture, Medical Man Cave, Kane's Furniture - Tampa (N. Dale Mabry), Ice Cave Body Sculpting - Tampa, Maximum Audio Video, Pinch A Penny Pool Patio Spa, Tampa Family Health Centers, Moramoto of Tampa Bay

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

(813) 287-5051

Website

naca.com

Open hoursSee all hours

Mon8:30 AM - 6 PMOpen

Plan your stay

Pet-friendly Hotels in Tampa

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in Tampa

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in Tampa

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

Private Pontoon Tours-Clearwater Relax & Explore

Mon, Jan 26 • 9:00 AM

Clearwater, Florida, 33755

View details

General Knowledge Trivia at Beef O Bradys - Oldsmar - $100 in prizes!

Tue, Jan 27 • 7:00 PM

3687 Tampa Rd,, Oldsmar, FL 34677

View details

Largo Senior Expo

Thu, Jan 29 • 10:00 AM

105 Central Park Drive, Largo, FL 33771

View details

Nearby restaurants of NACA

Otsuka Ramen

Danny's Coffee & Friends

Taco Bell

Big G's Pizza & Grille

McDonald's

TNT BURGER

Marlene's Original Breakfast Sandwich

Dunkin'

SATA Empanada

Coco Loco Cafe

Otsuka Ramen

4.6

(357)

$

Closed

Click for details

Danny's Coffee & Friends

4.8

(91)

$

Closed

Click for details

Taco Bell

3.5

(842)

$

Closed

Click for details

Big G's Pizza & Grille

4.3

(765)

$

Closed

Click for details

Nearby local services of NACA

Cody Pools

Cox's Seafood Market

Palm Casual Patio Furniture

Medical Man Cave

Kane's Furniture - Tampa (N. Dale Mabry)

Ice Cave Body Sculpting - Tampa

Maximum Audio Video

Pinch A Penny Pool Patio Spa

Tampa Family Health Centers

Moramoto of Tampa Bay

Cody Pools

4.4

(515)

Click for details

Cox's Seafood Market

4.5

(383)

Click for details

Palm Casual Patio Furniture

5.0

(696)

Click for details

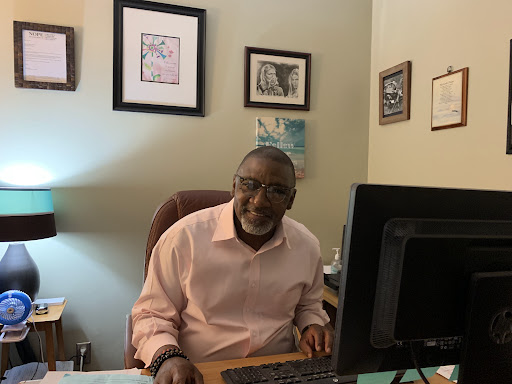

Medical Man Cave

4.8

(18)

Click for details