Temple View Capital things to do, attractions, restaurants, events info and trip planning

Basic Info

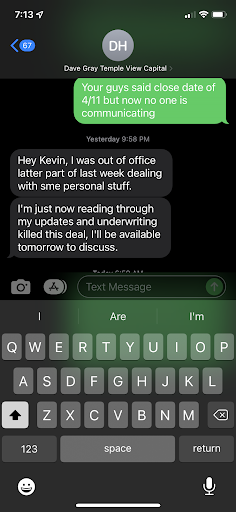

Temple View Capital

7550 Wisconsin Ave STE 1000, Bethesda, MD 20814

3.9(75)

Closed

Save

spot

spot

Ratings & Description

Info

attractions: Round House Theatre, Bethesda station, Gallery B, Waverly Street Gallery, Caroline Freeland Urban Park, Amy Kaslow Gallery, Chase Avenue Urban Park, DeVry University Bethesda, Maryland, Bethesda Fine Art, Bethesda Row Arts Festival, restaurants: Sweeteria Bethesda, Pisco y Nazca Bethesda, Andy's Pizza Bethesda, &pizza, The Original Pancake House, Ceremony Coffee Bethesda Crescent, Tastee Diner, Black's Bar & Kitchen, Hip Flask Rooftop Bar, Pita On The plaza, local businesses: KID Museum Bethesda Metro Center, Bethesda Metro Station, Encrypted Escape Bethesda, Bethesda Salt Cave, 7 Days Spa, AnuNatural NailsStudio, Jewelry Store Bethesda MD Dealers In Dreams: Goldsmiths Dealers in Dreams, Everett Hall Boutique, Landmark's Bethesda Row Cinema, Bethesda Metro Center

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

(844) 232-7878

Website

templeviewcap.com

Open hoursSee all hours

Tue9 AM - 5 PMClosed

Plan your stay

Pet-friendly Hotels in Bethesda

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in Bethesda

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in Bethesda

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

Bubble Planet: An Immersive Experience in Washington DC

Wed, Feb 18 • 9:30 AM

524 Rhode Island Ave NE, 20002

View details

Marvel at the National Mall at night with a guide

Sat, Feb 21 • 7:00 PM

Washington, District of Columbia, 20001

View details

Dining in the Dark: A Unique Blindfolded Experience at Ambar Clarendon

Sun, Feb 22 • 6:00 PM

2901 Wilson Blvd, Arlington, 22201

View details

Nearby attractions of Temple View Capital

Round House Theatre

Bethesda station

Gallery B

Waverly Street Gallery

Caroline Freeland Urban Park

Amy Kaslow Gallery

Chase Avenue Urban Park

DeVry University Bethesda, Maryland

Bethesda Fine Art

Bethesda Row Arts Festival

Round House Theatre

4.7

(221)

Open 24 hours

Click for details

Bethesda station

4.5

(13)

Open 24 hours

Click for details

Gallery B

4.5

(7)

Open until 12:00 AM

Click for details

Waverly Street Gallery

4.5

(13)

Open until 12:00 AM

Click for details

Nearby restaurants of Temple View Capital

Sweeteria Bethesda

Pisco y Nazca Bethesda

Andy's Pizza Bethesda

&pizza

The Original Pancake House

Ceremony Coffee Bethesda Crescent

Tastee Diner

Black's Bar & Kitchen

Hip Flask Rooftop Bar

Pita On The plaza

Sweeteria Bethesda

4.9

(13)

Open until 9:00 PM

Click for details

Pisco y Nazca Bethesda

4.9

(2.7K)

$$

Open until 10:00 PM

Click for details

Andy's Pizza Bethesda

4.7

(648)

$

Open until 10:00 PM

Click for details

&pizza

4.4

(445)

$

Open until 10:00 PM

Click for details

Nearby local services of Temple View Capital

KID Museum Bethesda Metro Center

Bethesda Metro Station

Encrypted Escape Bethesda

Bethesda Salt Cave

7 Days Spa

AnuNatural NailsStudio

Jewelry Store Bethesda MD Dealers In Dreams: Goldsmiths Dealers in Dreams

Everett Hall Boutique

Landmark's Bethesda Row Cinema

Bethesda Metro Center

KID Museum Bethesda Metro Center

4.5

(72)

Click for details

Bethesda Metro Station

4.6

(30)

Click for details

Encrypted Escape Bethesda

5.0

(289)

Click for details

Bethesda Salt Cave

4.5

(112)

Click for details