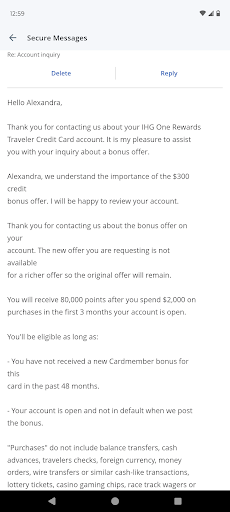

383 Madison Avenue things to do, attractions, restaurants, events info and trip planning

Basic Info

383 Madison Avenue

383 Madison Ave, New York, NY 10017

3.0(105)

Open until 12:00 AM

Save

spot

spot

Ratings & Description

Info

Cultural

attractions: Rockefeller Center, Grand Central Terminal, SUMMIT One Vanderbilt, St. Patrick's Cathedral, MetLife Building, The Escape Game NYC (Midtown Manhattan), Chrysler Building, Church of Sweden, Secret City Scavenger Hunts, Radio City Music Hall, restaurants: Uncle Paul's Pizza, Vanderbilt Market - Bars & Eateries, The Best Sichuan, Benny John's Bar and Grill, Katsu-Hama, Maggie's Place, Mysttik Masaala, Ammos Estiatorio, Wolf & Lamb Steakhouse, Bobby Van's 230Park, local businesses: adidas Flagship Store New York, Grand Central - LIRR Concourse, Best Buy, Grand Central Terminal, NBA Store, H&M, Jos A. Bank, Consulate General of Algeria in New York, DOI Camera, SAYKI Menswear

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Website

jpmorgan.com

Open hoursSee all hours

SatClosedOpen

Plan your stay

Pet-friendly Hotels in New York

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in New York

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in New York

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

The Full-Day See It All NYC Tour

Sun, Feb 15 • 10:00 AM

New York, New York, 10019

View details

Cupids Cocktail Valentines Day Mixology & Brunch

Sat, Feb 14 • 12:00 PM

247 Washington Avenue Carteret, NJ 07008

View details

Valentines Dress to Kill Murder Mystery Dinner

Sun, Feb 15 • 6:00 PM

1020 Broad Street Newark, NJ 07102

View details

Nearby attractions of 383 Madison Avenue

Rockefeller Center

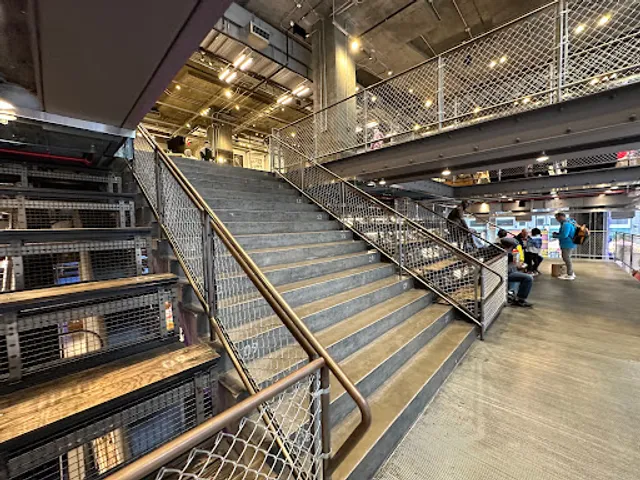

Grand Central Terminal

SUMMIT One Vanderbilt

St. Patrick's Cathedral

MetLife Building

The Escape Game NYC (Midtown Manhattan)

Chrysler Building

Church of Sweden

Secret City Scavenger Hunts

Radio City Music Hall

Rockefeller Center

4.7

(62.2K)

Open until 12:00 AM

Click for details

Grand Central Terminal

4.8

(11.8K)

Closed

Click for details

SUMMIT One Vanderbilt

4.7

(12.3K)

Closed

Click for details

St. Patrick's Cathedral

4.8

(14.9K)

Open 24 hours

Click for details

Nearby restaurants of 383 Madison Avenue

Uncle Paul's Pizza

Vanderbilt Market - Bars & Eateries

The Best Sichuan

Benny John's Bar and Grill

Katsu-Hama

Maggie's Place

Mysttik Masaala

Ammos Estiatorio

Wolf & Lamb Steakhouse

Bobby Van's 230Park

Uncle Paul's Pizza

4.4

(1.2K)

$

Closed

Click for details

Vanderbilt Market - Bars & Eateries

4.4

(1.5K)

$

Closed

Click for details

The Best Sichuan

4.8

(1.3K)

$$

Closed

Click for details

Benny John's Bar and Grill

4.8

(1.1K)

$$$

Closed

Click for details

Nearby local services of 383 Madison Avenue

adidas Flagship Store New York

Grand Central - LIRR Concourse

Best Buy

Grand Central Terminal

NBA Store

H&M

Jos A. Bank

Consulate General of Algeria in New York

DOI Camera

SAYKI Menswear

adidas Flagship Store New York

4.3

(2.5K)

Click for details

Grand Central - LIRR Concourse

4.5

(180)

Click for details

Best Buy

4.1

(6.8K)

Click for details

Grand Central Terminal

4.7

(3.1K)

Click for details