Minnesota Department of Revenue things to do, attractions, restaurants, events info and trip planning

Basic Info

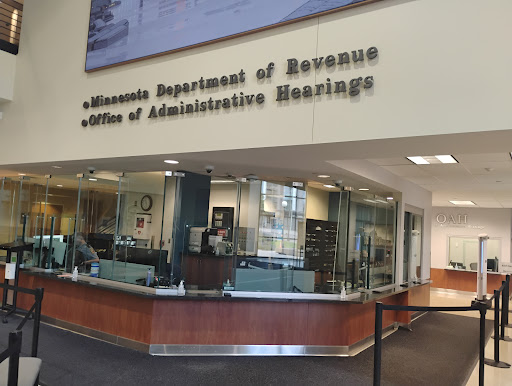

Minnesota Department of Revenue

600 Robert St N, St Paul, MN 55101

2.2(132)

Open until 4:30 PM

Save

spot

spot

Ratings & Description

Info

Cultural

Accessibility

attractions: Minnesota State Capitol, History Theatre, Pedro Park, St Louis King Of France Church, Upper Mall Minnesota State Capitol, Fitzgerald Theater, Minnesota State Law Library, Cass Gilbert Memorial Park, Minnesota Children's Museum, Palace Theatre, restaurants: Keys Cafe & Bakery, Sawatdee Saint Paul, Camp Bar and Cabaret, Laugh Camp Comedy Club, Alary's Bar, Jimmy John's, The Buttered Tin, Hope Express, Mama Thai Kitchen, Dark Horse Bar & Eatery, local businesses: Atelier957, Accessory City, St. Paul-Ramsey County Public Health, Ramsey County Social Services, Mickey's Diner, Town Square Complex, Original Candyland store, Ramsey County Child Support, Peters market inc, TRIA Rink St. Paul

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

(651) 556-3000

Website

revenue.state.mn.us

Open hoursSee all hours

Wed8 AM - 4:30 PMOpen

Plan your stay

Pet-friendly Hotels in Saint Paul

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in Saint Paul

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in Saint Paul

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

Play with clay

Wed, Jan 28 • 3:00 PM

Minneapolis, Minnesota, 55418

View details

Minneapolis Foodies: Flavors, Hidden Gems & River

Thu, Jan 29 • 11:00 AM

Minneapolis, Minnesota, 55401

View details

LUMINISCENCE Minneapolis: An Immersive Celebration of Light, Sound and Story

Thu, Jan 29 • 7:00 PM

1600 Hennepin Ave, Minneapolis, 55403

View details

Nearby attractions of Minnesota Department of Revenue

Minnesota State Capitol

History Theatre

Pedro Park

St Louis King Of France Church

Upper Mall Minnesota State Capitol

Fitzgerald Theater

Minnesota State Law Library

Cass Gilbert Memorial Park

Minnesota Children's Museum

Palace Theatre

Minnesota State Capitol

4.7

(409)

Open until 5:00 PM

Click for details

History Theatre

4.7

(316)

Open 24 hours

Click for details

Pedro Park

4.2

(44)

Open until 12:00 AM

Click for details

St Louis King Of France Church

4.9

(107)

Closed

Click for details

Nearby restaurants of Minnesota Department of Revenue

Keys Cafe & Bakery

Sawatdee Saint Paul

Camp Bar and Cabaret

Laugh Camp Comedy Club

Alary's Bar

Jimmy John's

The Buttered Tin

Hope Express

Mama Thai Kitchen

Dark Horse Bar & Eatery

Keys Cafe & Bakery

4.5

(956)

$

Open until 8:00 PM

Click for details

Sawatdee Saint Paul

4.0

(498)

$

Open until 9:00 PM

Click for details

Camp Bar and Cabaret

4.3

(232)

$$

Closed

Click for details

Laugh Camp Comedy Club

4.7

(132)

Open until 12:00 AM

Click for details

Nearby local services of Minnesota Department of Revenue

Atelier957

Accessory City

St. Paul-Ramsey County Public Health

Ramsey County Social Services

Mickey's Diner

Town Square Complex

Original Candyland store

Ramsey County Child Support

Peters market inc

TRIA Rink St. Paul

Atelier957

4.6

(23)

Click for details

Accessory City

4.8

(37)

Click for details

St. Paul-Ramsey County Public Health

3.3

(18)

Click for details

Ramsey County Social Services

3.4

(281)

Click for details