State Home Mortgage things to do, attractions, restaurants, events info and trip planning

Basic Info

State Home Mortgage

60 Executive Park S, Atlanta, GA 30329, United States

1.6(190)

Open until 12:00 AM

Save

spot

spot

Ratings & Description

Info

attractions: Little Free Library, Shady Valley Park, Peachtree Creek Greenway N. Druid Hills Trailhead, The Salvation Army Atlanta Temple Corps, restaurants: Pancho's Mexican Restaurant & Cantina, Cuzco Peruvian Cuisine, Serenity Bar & Lounge, Kategna Ethiopian Cuisine, Waffle House, Biswas Grocery and Cafe, P Sports Bar, Havana Sandwich Shop, Da Spot Bistro, Veterans Vegan, local businesses: Dulce Garcia - State Farm Insurance Agent, Valor Behavioral Health, European Kitchen & BathWorks, 10 Executive Park E, Lost-N-Found Youth- Thrift Store, Guitar Center, Wawa Spa | Massage Atlanta GA, Aqua Nail & Beauty, Quality Health Spa Asian Massage, Lidl

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

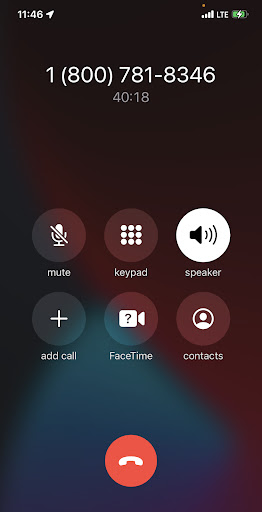

+1 800-781-8346

Website

statehomemortgage.net

Open hoursSee all hours

SunClosedOpen

Plan your stay

Pet-friendly Hotels in Brookhaven

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in Brookhaven

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in Brookhaven

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

Innercise Yoga at Mutation Brewing - January

Sun, Jan 25 • 11:30 AM

5825 Roswell Road Northeast Sandy Springs, GA 30328

View details

Buzz Happy Hour | The Beer Growler - January

Wed, Jan 28 • 6:00 PM

1418 Dresden Drive #suite 160 Brookhaven, GA 30319

View details

Atlanta, GA - UNO Night @ Punch Bowl Social

Wed, Jan 28 • 7:00 PM

875 Battery Avenue Southeast #Ste 720 Atlanta, GA 30339

View details

Nearby attractions of State Home Mortgage

Little Free Library

Shady Valley Park

Peachtree Creek Greenway N. Druid Hills Trailhead

The Salvation Army Atlanta Temple Corps

Little Free Library

3.7

(5)

Open until 12:00 AM

Click for details

Shady Valley Park

4.3

(203)

Open until 11:00 PM

Click for details

Peachtree Creek Greenway N. Druid Hills Trailhead

4.5

(21)

Open until 11:00 PM

Click for details

The Salvation Army Atlanta Temple Corps

4.7

(28)

Open until 12:00 AM

Click for details

Nearby restaurants of State Home Mortgage

Pancho's Mexican Restaurant & Cantina

Cuzco Peruvian Cuisine

Serenity Bar & Lounge

Kategna Ethiopian Cuisine

Waffle House

Biswas Grocery and Cafe

P Sports Bar

Havana Sandwich Shop

Da Spot Bistro

Veterans Vegan

Pancho's Mexican Restaurant & Cantina

4.0

(654)

$

Closed

Click for details

Cuzco Peruvian Cuisine

4.7

(342)

$$

Closed

Click for details

Serenity Bar & Lounge

4.8

(99)

$$

Closed

Click for details

Kategna Ethiopian Cuisine

4.6

(165)

$

Open until 12:00 AM

Click for details

Nearby local services of State Home Mortgage

Dulce Garcia - State Farm Insurance Agent

Valor Behavioral Health

European Kitchen & BathWorks

10 Executive Park E

Lost-N-Found Youth- Thrift Store

Guitar Center

Wawa Spa | Massage Atlanta GA

Aqua Nail & Beauty

Quality Health Spa Asian Massage

Lidl

Dulce Garcia - State Farm Insurance Agent

5.0

(88)

Click for details

Valor Behavioral Health

4.7

(52)

Click for details

European Kitchen & BathWorks

4.6

(39)

Click for details

10 Executive Park E

4.5

(311)

Click for details