Morty things to do, attractions, restaurants, events info and trip planning

Basic Info

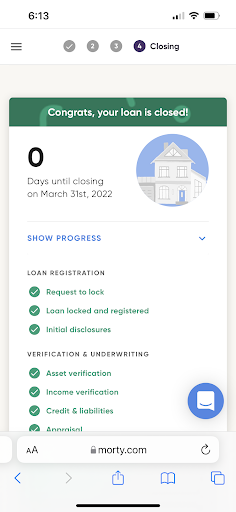

Morty

180 Varick St #816, New York, NY 10014, United States

4.7(29)

Open until 12:00 AM

Save

spot

spot

Ratings & Description

Info

Cultural

attractions: Color Factory - NYC Interactive Art Museum, SoHo Playhouse, The Greene Space, Greater New York Federal Building, New York City Fire Museum, Father Fagan Park, James J Walker Park, HERE Arts Center, Spring Street Park, Hudson Park Library, restaurants: Essen Fast Slow Food, Houston Hall, Shuka, Westville Hudson, Hamburger America, Emily, Dominique Ansel Bakery, Port Sa’id, Lola Taverna, Top Thai 55 Carmine, local businesses: 60 Charlton Street, CocuSocial, ARROJO Academy, Manhattan Mini Storage, Chopt Creative Salad Co., Arrojo Studio, Film Forum, New York Passport Agency, Best in Class Barbershop, Tend Dental West Village

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

+1 844-457-8564

Website

morty.com

Open hoursSee all hours

Mon9 a.m. - 5 p.m.Open

Plan your stay

Pet-friendly Hotels in New York

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in New York

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in New York

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

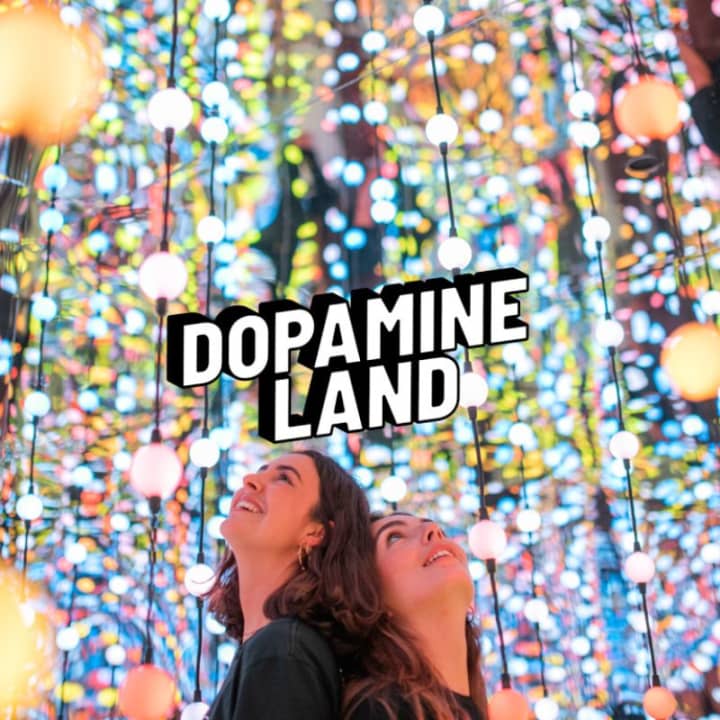

Dopamine Land: A Multisensory Experience

Mon, Feb 16 • 11:00 AM

One Garden State Plaza Pkwy, Paramus, 07652

View details

Thomas Paine and Rights of Man with Dr. Frances Chiu

Sat, Feb 21 • 4:00 PM

983 North Avenue New Rochelle, NY 10804

View details

The Ultimate Greenwich Village Food Tour

Mon, Feb 16 • 10:30 AM

New York, New York, 10003

View details

Nearby attractions of Morty

Color Factory - NYC Interactive Art Museum

SoHo Playhouse

The Greene Space

Greater New York Federal Building

New York City Fire Museum

Father Fagan Park

James J Walker Park

HERE Arts Center

Spring Street Park

Hudson Park Library

Color Factory - NYC Interactive Art Museum

4.4

(2.1K)

Closed

Click for details

SoHo Playhouse

4.5

(343)

Open 24 hours

Click for details

The Greene Space

4.7

(88)

Closed

Click for details

Greater New York Federal Building

4.4

(152)

Open 24 hours

Click for details

Nearby restaurants of Morty

Essen Fast Slow Food

Houston Hall

Shuka

Westville Hudson

Hamburger America

Emily

Dominique Ansel Bakery

Port Sa’id

Lola Taverna

Top Thai 55 Carmine

Essen Fast Slow Food

4.1

(551)

$

Open until 12:00 AM

Click for details

Houston Hall

4.2

(778)

$$

Open until 12:00 AM

Click for details

Shuka

4.6

(1.7K)

$$

Closed

Click for details

Westville Hudson

4.5

(757)

$$

Closed

Click for details

Nearby local services of Morty

60 Charlton Street

CocuSocial

ARROJO Academy

Manhattan Mini Storage

Chopt Creative Salad Co.

Arrojo Studio

Film Forum

New York Passport Agency

Best in Class Barbershop

Tend Dental West Village

60 Charlton Street

5.0

(854)

Click for details

CocuSocial

4.9

(828)

Click for details

ARROJO Academy

4.7

(143)

Click for details

Manhattan Mini Storage

4.9

(473)

Click for details