Masterworks things to do, attractions, restaurants, events info and trip planning

Basic Info

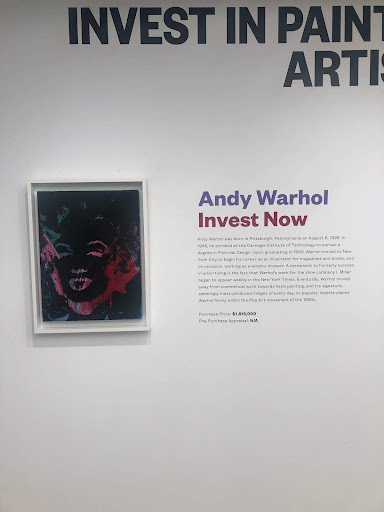

Masterworks

1 World Trade Center, New York, NY 10007

4.2(308)

Open until 12:00 AM

Save

spot

spot

Ratings & Description

Info

Cultural

attractions: One World Trade Center, One World Observatory, 9/11 Memorial & Museum, 9/11 Memorial Pools, North Tower Pool, The Squadron NYC, Perelman Performing Arts Center (PAC NYC), Silverstein Family Park, Fiterman Hall, Twin Towers, restaurants: ONE Dine at One World Observatory, Joe Coffee Company: Westfield at WTC, Wasabi sushi & bento, Le District, POOM: Bakers Collective, Sant Ambroeus Brookfield, P.J. Clarke's On The Hudson, Tartinery Café - Bar | Hudson Eats, El Vez and Burrito Bar, Pret A Manger, local businesses: Better, TheGuarantors, Marshalls, Apple World Trade Center, World Trade Center, World Trade Center, Ground Zero, 185 Greenwich St, Couture Clean New York, Oculus Center

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

(203) 518-5172

Website

masterworks.com

Open hoursSee all hours

SatClosedOpen

Plan your stay

Pet-friendly Hotels in New York

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in New York

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in New York

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

THE COLDEST WINTER EVER: Black Mafia Edition!

Fri, Feb 27 • 9:00 PM

1096 Convery Blvd. Perth Amboy, NJ 07076

View details

A Minority Wellness Event by Dank Diamonds

Sat, Feb 28 • 2:00 PM

51 Austin Street Newark, NJ 07114

View details

Vision Board & Vibes: A Night for Sisterhood & Strategy

Sat, Feb 28 • 5:00 PM

167 Lakeview Avenue Clifton, NJ 07011

View details

Nearby attractions of Masterworks

One World Trade Center

One World Observatory

9/11 Memorial & Museum

9/11 Memorial Pools

North Tower Pool

The Squadron NYC

Perelman Performing Arts Center (PAC NYC)

Silverstein Family Park

Fiterman Hall

Twin Towers

One World Trade Center

4.8

(11K)

Open 24 hours

Click for details

One World Observatory

4.7

(9.5K)

Closed

Click for details

9/11 Memorial & Museum

4.8

(6.2K)

Closed

Click for details

9/11 Memorial Pools

4.9

(6.3K)

Closed

Click for details

Nearby restaurants of Masterworks

ONE Dine at One World Observatory

Joe Coffee Company: Westfield at WTC

Wasabi sushi & bento

Le District

POOM: Bakers Collective

Sant Ambroeus Brookfield

P.J. Clarke's On The Hudson

Tartinery Café - Bar | Hudson Eats

El Vez and Burrito Bar

Pret A Manger

ONE Dine at One World Observatory

4.3

(1.0K)

$$$$

Closed

Click for details

Joe Coffee Company: Westfield at WTC

4.3

(183)

$

Open until 12:00 AM

Click for details

Wasabi sushi & bento

4.1

(238)

$

Closed

Click for details

Le District

4.3

(1.2K)

$

Closed

Click for details

Nearby local services of Masterworks

Better

TheGuarantors

Marshalls

Apple World Trade Center

World Trade Center

World Trade Center

Ground Zero

185 Greenwich St

Couture Clean New York

Oculus Center

Better

4.6

(1.5K)

Click for details

TheGuarantors

4.6

(509)

Click for details

Marshalls

4.4

(973)

Click for details

Apple World Trade Center

4.3

(2.1K)

Click for details