Georgia United Credit Union things to do, attractions, restaurants, events info and trip planning

Basic Info

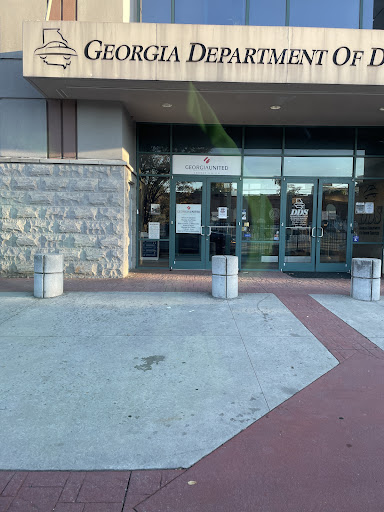

Georgia United Credit Union

101 Marietta St NW # 140, Atlanta, GA 30303

4.5(142)

Closed

Save

spot

spot

Ratings & Description

Info

attractions: Fairlie-Poplar District, SkyView Atlanta, Tabernacle, Centennial Olympic Park, Rialto Center for the Arts at Georgia State University, Theatrical Outfit, Gallery 72, Fountain of Rings, AmericasMart Atlanta, College Football Hall of Fame, restaurants: Hudson Grille, Thrive, Baraka Shawarma Atlanta, Glenn's Kitchen, Park Bar, Just Around the Corner, Margaritaville Restaurant - Atlanta, J.A.T.C Cuisine ATL, The Food Shoppe, Slice Downtown, local businesses: Centennial Tower, Atlanta Hawks, L David Wolfe PC: Attorney, Best Of Atlanta Gift shop, Sapphire Deck Parking Garage, Tea Around Town, Georgia World Congress Center, Lanier Parking (Georgia Bar Parking Garage), Peachtree Tower, 2 City Plaza

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

(770) 476-6459

Website

gucu.org

Open hoursSee all hours

Tue9 AM - 5 PMClosed

Plan your stay

Pet-friendly Hotels in Atlanta

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in Atlanta

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in Atlanta

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

FAT TUESDAY !!! BIGGEST MARDI GRAS PARTY IN ATLANTA!!!

Tue, Feb 17 • 9:00 PM

2851 Buford Highway Northeast Atlanta, GA 30329

View details

Little Hearts, Strong Starts

Wed, Feb 18 • 10:15 AM

3820 Macedonia Road Powder Springs, GA 30127

View details

Goldfish Swim School Sandy Springs Family Fun Fair

Sat, Feb 21 • 2:00 PM

6335 Roswell Road Sandy Springs, GA 30328

View details

Nearby attractions of Georgia United Credit Union

Fairlie-Poplar District

SkyView Atlanta

Tabernacle

Centennial Olympic Park

Rialto Center for the Arts at Georgia State University

Theatrical Outfit

Gallery 72

Fountain of Rings

AmericasMart Atlanta

College Football Hall of Fame

Fairlie-Poplar District

4.3

(1.4K)

Open until 12:00 AM

Click for details

SkyView Atlanta

4.5

(4.3K)

Open until 10:00 PM

Click for details

Tabernacle

4.6

(2.6K)

Open 24 hours

Click for details

Centennial Olympic Park

4.6

(6K)

Open until 10:00 PM

Click for details

Nearby restaurants of Georgia United Credit Union

Hudson Grille

Thrive

Baraka Shawarma Atlanta

Glenn's Kitchen

Park Bar

Just Around the Corner

Margaritaville Restaurant - Atlanta

J.A.T.C Cuisine ATL

The Food Shoppe

Slice Downtown

Hudson Grille

3.8

(2K)

$$

Open until 12:00 AM

Click for details

Thrive

4.2

(544)

$$

Open until 9:00 PM

Click for details

Baraka Shawarma Atlanta

4.6

(727)

$

Open until 10:00 PM

Click for details

Glenn's Kitchen

4.3

(257)

$$

Open until 9:00 PM

Click for details

Nearby local services of Georgia United Credit Union

Centennial Tower

Atlanta Hawks

L David Wolfe PC: Attorney

Best Of Atlanta Gift shop

Sapphire Deck Parking Garage

Tea Around Town

Georgia World Congress Center

Lanier Parking (Georgia Bar Parking Garage)

Peachtree Tower

2 City Plaza

Centennial Tower

4.7

(39)

Click for details

Atlanta Hawks

4.5

(33)

Click for details

L David Wolfe PC: Attorney

4.4

(12)

Click for details

Best Of Atlanta Gift shop

4.8

(211)

Click for details

The hit list

Plan your trip with Wanderboat

Welcome to Wanderboat AI, your AI search for local Eats and Fun, designed to help you explore your city and the world with ease.

Powered by Wanderboat AI trip planner.