FS Insight (aka Fundstrat aka FSInsight) things to do, attractions, restaurants, events info and trip planning

Basic Info

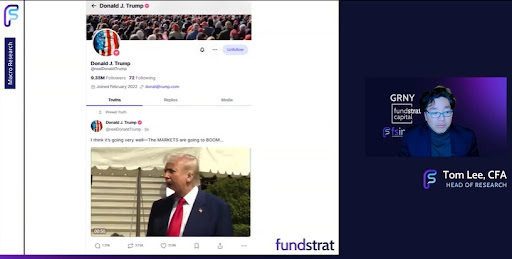

FS Insight (aka Fundstrat aka FSInsight)

150 E 52nd St, New York, NY 10022

4.9(519)

Closed

Save

spot

spot

Ratings & Description

Info

Cultural

attractions: Greenacre Park, Marilyn Monroe's subway grate🎬, St. Bartholomew's Church, Saint Peter's Church, St. Patrick's Cathedral, Islamic Society of Mid Manhattan, Central Synagogue, Rockefeller Center, Park Avenue Plaza, Galleria On Third, restaurants: Ess-a-Bagel, Gu Japanese Fusion Sushi & Bar, Empire Steak House, OBAO Midtown, New York Luncheonette, Restaurant Nippon, Dig Inn, Spice Symphony, Smith & Wollensky, The Hugh, local businesses: TMPL - Lexington, KUR Skin Lab, Xpress Barber Shop, Matii Hair Salon, A's Body Works, NYU Langone Fertility Center, 51 St, ThisPix, Lexington Av/53 St, FDNY Engine 8/Ladder 2/Battalion 8

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

(212) 293-7140 ext. 2

Website

fsinsight.com

Open hoursSee all hours

Tue8 AM - 6 PMClosed

Plan your stay

Pet-friendly Hotels in New York

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in New York

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in New York

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

ARTE MUSEUM: An Immersive Media Art Exhibition

Tue, Feb 17 • 10:00 AM

61 Chelsea Piers, New York, 10011

View details

The Full-Day See It All NYC Tour

Tue, Feb 17 • 10:30 AM

New York, New York, 10019

View details

GHBC Presents: Coleman Williams (IV) & Lightnin Luke!

Tue, Feb 17 • 7:00 PM

321 River Road #6 Clifton, NJ 07014

View details

Nearby attractions of FS Insight (aka Fundstrat aka FSInsight)

Greenacre Park

Marilyn Monroe's subway grate🎬

St. Bartholomew's Church

Saint Peter's Church

St. Patrick's Cathedral

Islamic Society of Mid Manhattan

Central Synagogue

Rockefeller Center

Park Avenue Plaza

Galleria On Third

Greenacre Park

4.8

(771)

Open 24 hours

Click for details

Marilyn Monroe's subway grate🎬

4.0

(65)

Open until 12:00 AM

Click for details

St. Bartholomew's Church

4.6

(404)

Closed

Click for details

Saint Peter's Church

4.6

(181)

Open until 12:00 AM

Click for details

Nearby restaurants of FS Insight (aka Fundstrat aka FSInsight)

Ess-a-Bagel

Gu Japanese Fusion Sushi & Bar

Empire Steak House

OBAO Midtown

New York Luncheonette

Restaurant Nippon

Dig Inn

Spice Symphony

Smith & Wollensky

The Hugh

Ess-a-Bagel

4.1

(2K)

$

Closed

Click for details

Gu Japanese Fusion Sushi & Bar

4.3

(298)

$$

Closed

Click for details

Empire Steak House

4.6

(1.1K)

$$$$

Closed

Click for details

OBAO Midtown

4.8

(2K)

$$

Closed

Click for details

Nearby local services of FS Insight (aka Fundstrat aka FSInsight)

TMPL - Lexington

KUR Skin Lab

Xpress Barber Shop

Matii Hair Salon

A's Body Works

NYU Langone Fertility Center

51 St

ThisPix

Lexington Av/53 St

FDNY Engine 8/Ladder 2/Battalion 8

TMPL - Lexington

4.5

(419)

Click for details

KUR Skin Lab

4.9

(326)

Click for details

Xpress Barber Shop

4.9

(98)

Click for details

Matii Hair Salon

4.6

(162)

Click for details