Rocket Mortgage things to do, attractions, restaurants, events info and trip planning

Basic Info

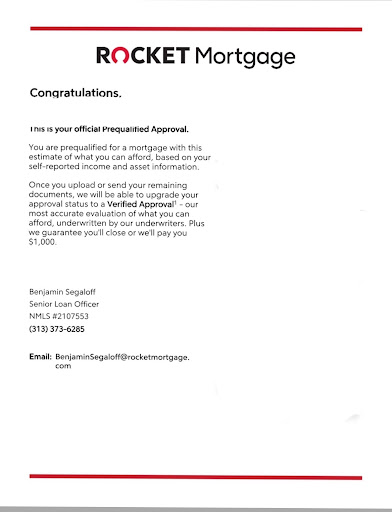

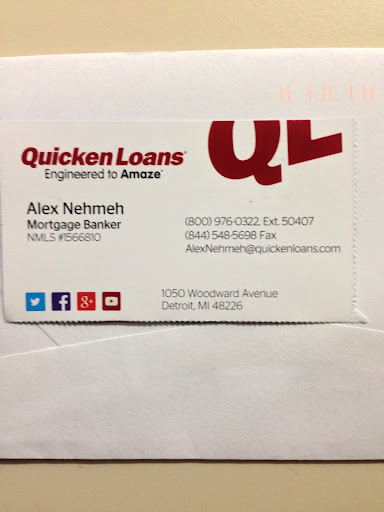

Rocket Mortgage

1050 Woodward Ave, Detroit, MI 48226, United States

3.8(729)

Save

spot

spot

Ratings & Description

Info

attractions: Campus Martius Park, Guardian Building, Cadillac Square Park, The BELT, Statue “Waiting” by KAWS, Cadillac Lodge, Michigan Soldiers' and Sailors' Monument, Saint Andrew’s Hall, Detroit Opera House, Motor City Church, restaurants: Texas de Brazil - Detroit, Sugar Factory - Detroit, Parc, ADELINA, Mootz Pizzeria + Bar, Detroit Water Ice Factory, Avalon Cafe and Bakery, The Hudson Cafe, Dime Store, Central Kitchen + Bar, local businesses: The Rink at Campus Martius, Nike Community Store - Detroit, The Rink At Campus Martius Park, CVS, One Campus Martius, One Campus Martius Garage, Penobscot Building, The Monroe Street Midway, New Cadillac Square Apartments, Citizen Yoga Detroit

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

+1 800-476-2538

Website

rocketmortgage.com

Plan your stay

Pet-friendly Hotels in Detroit

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in Detroit

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in Detroit

Find a cozy hotel nearby and make it a full experience.

Reviews

Live events

The Jury Experience – Death by AI: Will Detroit Deliver Justice?

Sun, Feb 15 • 4:30 PM

333 Madison Street, Detroit, 48226

View details

Galentines Day @ Sidetrack Bookshop

Sun, Feb 15 • 11:00 AM

325 S. Washington Ave. Royal Oak, MI 48067

View details

In-person Free Robotics Workshop For Kids at Troy, OH(7-14 yrs)

Sun, Feb 15 • 11:00 AM

400 Stephenson Highway Troy, MI 48083

View details

Nearby attractions of Rocket Mortgage

Campus Martius Park

Guardian Building

Cadillac Square Park

The BELT

Statue “Waiting” by KAWS

Cadillac Lodge

Michigan Soldiers' and Sailors' Monument

Saint Andrew’s Hall

Detroit Opera House

Motor City Church

Campus Martius Park

4.7

(5.1K)

Open until 9:00 PM

Click for details

Guardian Building

4.7

(1.2K)

Open until 12:00 AM

Click for details

Cadillac Square Park

4.5

(68)

Open until 10:00 PM

Click for details

The BELT

4.6

(339)

Closed

Click for details

Nearby restaurants of Rocket Mortgage

Texas de Brazil - Detroit

Sugar Factory - Detroit

Parc

ADELINA

Mootz Pizzeria + Bar

Detroit Water Ice Factory

Avalon Cafe and Bakery

The Hudson Cafe

Dime Store

Central Kitchen + Bar

Texas de Brazil - Detroit

4.3

(2.4K)

$$$

Closed

Click for details

Sugar Factory - Detroit

3.9

(2K)

$$

Open until 11:00 PM

Click for details

Parc

4.6

(2.1K)

$$$$

Open until 9:00 PM

Click for details

ADELINA

4.7

(677)

$$$

Closed

Click for details

Nearby local services of Rocket Mortgage

The Rink at Campus Martius

Nike Community Store - Detroit

The Rink At Campus Martius Park

CVS

One Campus Martius

One Campus Martius Garage

Penobscot Building

The Monroe Street Midway

New Cadillac Square Apartments

Citizen Yoga Detroit

The Rink at Campus Martius

4.5

(189)

Click for details

Nike Community Store - Detroit

4.4

(1.1K)

Click for details

The Rink At Campus Martius Park

4.6

(161)

Click for details

CVS

3.5

(80)

Click for details

The hit list

Plan your trip with Wanderboat

Welcome to Wanderboat AI, your AI search for local Eats and Fun, designed to help you explore your city and the world with ease.

Powered by Wanderboat AI trip planner.