EcoHome Financial things to do, attractions, restaurants, events info and trip planning

Basic Info

EcoHome Financial

8 Spadina Ave. Suite #2400, Toronto, ON M5V 0S8, Canada

4.2(294)

Save

spot

spot

Ratings & Description

Info

attractions: Arcadia Earth Toronto, Rogers Centre, Clarence Square, CN Tower, Ripley's Aquarium of Canada, Canoe Landing Park, Metro Toronto Convention Centre, Princess of Wales Theatre, Niagara Falls Canada Tours - Niagara Falls Sightseeing Tours & Boat Cruise From Toronto, Toronto Music Garden, restaurants: Aera, L’Avenue, De Mello Coffee, Ramen Ryu, Blue Claw Lobster Shack, Chen Chen's Nashville Hot Chicken, BHC Chicken Toronto, Siempre Breakfast & Lunch, Prince Street Pizza, Lulu Bar Toronto, local businesses: The Well, Wellington Market, The Well - Building G, Clarence Square, Sobeys Urban Fresh Spadina, The Gem Studio Toronto, FourFifty The Well Apartments, Rabba Fine Foods, The Well Condominium, Little Harvest Market

Learn more insights from Wanderboat AI.

Learn more insights from Wanderboat AI.Phone

(866) 382-7468

Website

ecohomefinancial.com

Plan your stay

Pet-friendly Hotels in Toronto

Find a cozy hotel nearby and make it a full experience.

Affordable Hotels in Toronto

Find a cozy hotel nearby and make it a full experience.

The Coolest Hotels You Haven't Heard Of (Yet)

Find a cozy hotel nearby and make it a full experience.

Trending Stays Worth the Hype in Toronto

Find a cozy hotel nearby and make it a full experience.

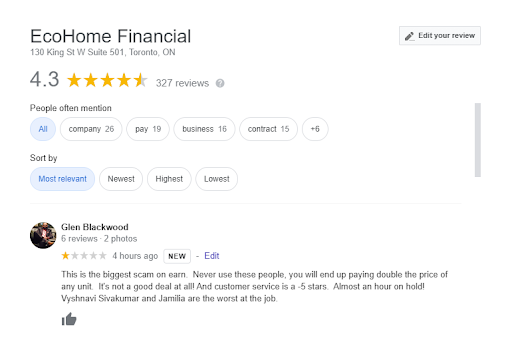

Reviews

Live events

Create a custom silver ring with a goldsmith

Thu, Feb 12 • 1:30 PM

Toronto, Ontario, M6J 0A8, Canada

View details

Show me the City

Fri, Feb 13 • 1:00 PM

Toronto, Ontario, M5J 1W9, Canada

View details

The Empire Strips Back: A Burlesque Parody

Thu, Feb 12 • 7:30 PM

608 College Street, Toronto, M6G 1B4

View details

Nearby attractions of EcoHome Financial

Arcadia Earth Toronto

Rogers Centre

Clarence Square

CN Tower

Ripley's Aquarium of Canada

Canoe Landing Park

Metro Toronto Convention Centre

Princess of Wales Theatre

Niagara Falls Canada Tours - Niagara Falls Sightseeing Tours & Boat Cruise From Toronto

Toronto Music Garden

Arcadia Earth Toronto

4.3

(1.1K)

Open until 7:00 PM

Click for details

Rogers Centre

4.5

(13.8K)

Open 24 hours

Click for details

Clarence Square

3.9

(292)

Open until 12:00 AM

Click for details

CN Tower

4.6

(27.8K)

Open until 9:00 PM

Click for details

Nearby restaurants of EcoHome Financial

Aera

L’Avenue

De Mello Coffee

Ramen Ryu

Blue Claw Lobster Shack

Chen Chen's Nashville Hot Chicken

BHC Chicken Toronto

Siempre Breakfast & Lunch

Prince Street Pizza

Lulu Bar Toronto

Aera

3.8

(681)

Closed

Click for details

L’Avenue

4.7

(966)

Open until 4:00 PM

Click for details

De Mello Coffee

4.2

(240)

Open until 5:00 PM

Click for details

Ramen Ryu

4.4

(200)

Open until 8:30 PM

Click for details

Nearby local services of EcoHome Financial

The Well

Wellington Market

The Well - Building G

Clarence Square

Sobeys Urban Fresh Spadina

The Gem Studio Toronto

FourFifty The Well Apartments

Rabba Fine Foods

The Well Condominium

Little Harvest Market

The Well

4.4

(1.1K)

Click for details

Wellington Market

4.4

(474)

Click for details

The Well - Building G

4.4

(50)

Click for details

Clarence Square

4.1

(262)

Click for details